New energy realities could extend coal’s role in global energy markets

Wood Mackenzie new Horizons report shows how energy security concerns, unprecedented power demand, and technological advances could extend coal’s life and reshape the global energy transition

Global coal demand could remain stronger for longer, with coal-fired power generation potentially staying dominant through 2030, well beyond current projections for peak coal, according to a new Horizons report from Wood Mackenzie.

The report titled ‘Staying power: How new energy realities risk extending coal’s sunset’ suggests that a confluence of factors, from a rapidly electrifying global economy to energy security priorities rising from geopolitical and cost shocks to Asia’s young and evolving coal fleet, could extend coal’s role as a vital power source well into the next decade and beyond.

“Extending coal's prominence through 2030 would fundamentally alter the global energy transition timeline. We're talking about delaying the phase-out of the world's most carbon-intensive fuel source during a critical decade for climate action,” said Anthony Knutson, global head, thermal coal markets at Wood Mackenzie. “While the long-term trajectory towards renewables remains intact, the path is proving far more complex than many anticipated as countries grapple with energy security and affordability concerns.”

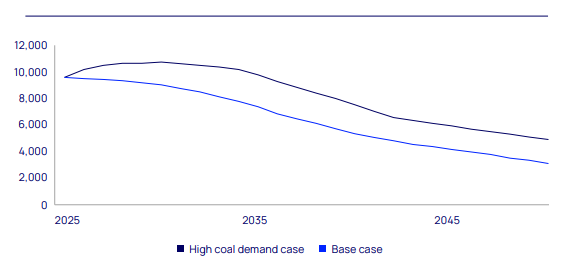

In Wood Mackenzie’s base-case Energy Transition Outlook, coal-fired power generation is projected to decline by nearly 70% between 2025 and 2050. This decline is driven by decreasing renewable energy costs, advancements in battery storage technology, a resurgence in nuclear energy, and an increase in natural gas capacity. However, Wood Mackenzie’s latest Horizons report highlights the potential for coal to remain demand to be stickier than expected. A ‘high coal demand’ case that offers a significantly different perspective: coal generation could average 32% higher than the base case through 2050.

Under the high coal demand case, output from global coal fleets is optimized to help meet steep and rapid load growth expectations, leading to significantly less renewable and gas energy deployment. This equates to 2,100 gigawatts (GW) less global wind, solar, energy storage, and natural gas capacity between 2025 and 2050. Without carbon capture and storage investment, unabated emissions from the coal sector would increase by two billion tonnes compared to the base case scenario.

Total global coal electricity generation, unabated, terawatt hours (TWh)

Source: Wood Mackenzie

Investment headwinds and shifting market forces

The latest Horizons report notes that a higher coal demand case will expose investment gaps in replacement coal supply, potentially raising prices by 2030. “Private equity and sovereign wealth funds will be needed to fund greenfield and brownfield mine expansions,” said Knutson. “We expect most Western financial institutions to continue limiting thermal coal investments, with the strongest impact on supply growth from 2025-2030 and longer-term market implications if supply replacement momentum is not maintained.”

According to the report, lack of commensurate investment is the largest risk facing coal markets now. Wood Mackenzie expects higher coal prices to erode the fuel's core cost advantage if demand increases without a supply response. “While we understand coal demand may remain resilient in coming years, eventually supply constraints will emerge, and this could accelerate price increases globally and erode future demand,” said Knutson.

Reimagined coal power offers potential pathways

The potential for carbon capture, utilisation, and storage (CCUS) offers a pathway to extend coal’s operational life in a decarbonising world. “CCUS could theoretically transform coal's environmental profile by capturing carbon dioxide emissions before they enter the atmosphere, but the economics remain challenging without substantial policy support and capital investment,” said David Brown, director, energy transition practice at Wood Mackenzie.

“Higher coal utilisation rates would improve the investment case, but we're still years away from cost-competitive deployment at scale, particularly in Asia, where carbon storage costs are likely to limit widespread adoption,” he added.

As governments and asset owners reposition for a low-carbon future, technologies that reduce the carbon intensity of coal must be prioritised. Without innovation in areas like CCUS, co-firing and flexible, load-following coal capacity to work in concert with renewables, a high coal demand scenario becomes increasingly difficult to justify. Where CCUS is deployed, pairing it with gas-fired generation may offer a more efficient path, given the lower CO₂ capture requirements per unit of electricity produced.

A new paradigm for global energy planning

While increased coal consumption represents neither an inevitable outcome nor an optimal scenario, current market trends indicate a significant transformation in global energy priorities. As nations develop comprehensive energy planning strategies, they are increasingly prioritizing energy sovereignty and domestic resource control to support their long-term objectives. This shift reflects countries' efforts to accelerate electrification initiatives that are both cost-effective and dependable for their populations, while maintaining greater autonomy in their energy planning decisions.

“Despite potential higher coal demand, we have the tools to phase it out,” Brown concluded. “Without urgent actions, the world faces a growing risk of drifting towards a 3°C pathway. Our high coal demand case is not a forecast, but it’s a warning of what inaction could bring, and a reminder of what can still be prevented.”

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.